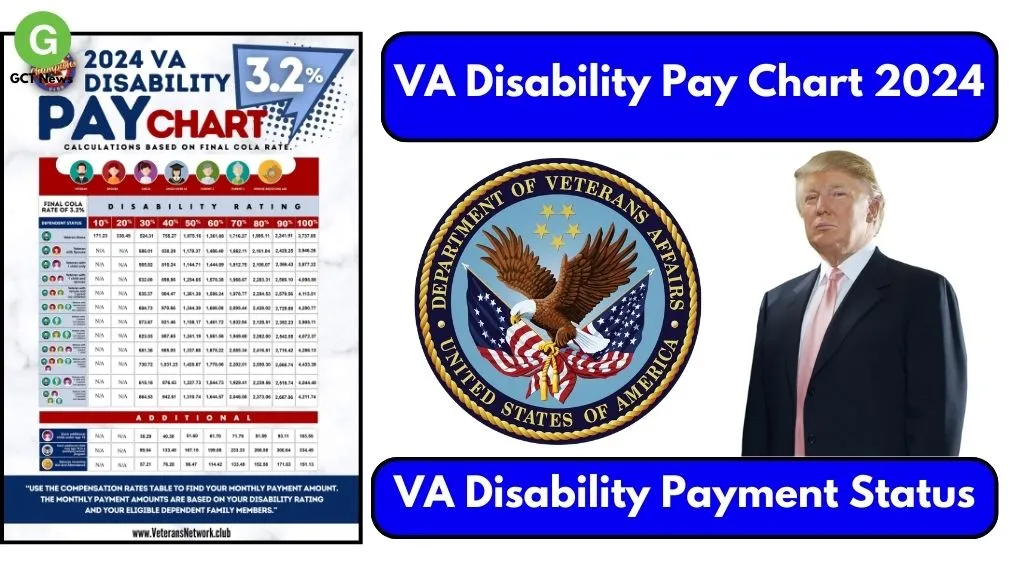

VA Disability Pay Chart 2024: The VA Disability Pay Chart 2024 has been updated to reflect a 3.2% cost-of-living adjustment (COLA), ensuring financial assistance for veterans coping with service-connected disabilities. This guide offers comprehensive details on the 2024 rates, additional compensations for dependents, and tips to help veterans maximize their benefits.

VA Disability Compensation

VA Disability Compensation is a tax-free monthly benefit provided to veterans who have suffered injuries or illnesses connected to their military service. The compensation amount is based on the disability rating, which ranges from 10% to 100%, determined in increments of 10%. Veterans with dependents, such as a spouse or children, may qualify for additional allowances.

VA Disability Pay Chart 2024

Here’s the updated monthly compensation for veterans without dependents:

| Disability Rating | Monthly Payment (2024) |

|---|---|

| 10% | $165.92 |

| 20% | $327.99 |

| 30% | $508.05 |

| 40% | $731.86 |

| 50% | $1,041.82 |

| 60% | $1,319.65 |

| 70% | $1,836.28 |

| 80% | $2,095.33 |

| 90% | $2,353.39 |

| 100% | $3,621.95 |

The VA ensures these payments are adjusted annually to account for inflation, maintaining the real value of the compensation.

Additional Compensation for Dependents

For veterans with a 30% or higher disability rating, additional allowances are provided for dependents. Below is a table illustrating the extra compensation for eligible dependents:

| Dependent Type | 30% | 50% | 70% | 100% |

|---|---|---|---|---|

| Spouse (no aid) | $60.00 | $95.00 | $134.00 | $191.14 |

| Spouse (with aid) | $113.50 | $172.00 | $267.00 | $334.49 |

| Child under 18 | $31.00 | $51.00 | $72.00 | $103.55 |

| School-aged child | $100.00 | $167.00 | $234.00 | $334.49 |

Additional compensations apply for dependent parents or if a veteran’s spouse requires aid and attendance for daily living.

How VA Disability Ratings Are Combined

When a veteran has multiple disabilities, the VA doesn’t simply add the percentages. Instead, it uses the Combined Ratings Table to determine the overall rating. For example:

- If you have two disabilities rated at 50% and 30%, your combined rating isn’t 80% but 65% due to how the VA calculates the remaining efficiency of the veteran.

Considerations

- Aid and Attendance Benefits: Veterans or spouses needing help with daily tasks can apply for additional benefits.

- Annual Adjustments: COLA ensures payments remain aligned with inflation, with the 3.2% adjustment applicable for 2024.

- Tax-Free Payments: Disability benefits are exempt from both federal and state taxes.

- Dependents Registration: Veterans with eligible dependents must ensure they are registered to receive additional compensation.

Tips to Maximize Your Benefits

- Request Rating Reassessment: If your condition worsens, file for a rating increase.

- Review Dependent Status: Ensure all eligible dependents are added for additional compensation.

- Seek Assistance: Consult VA-accredited representatives for help with claims or appeals.

How to Check Your VA Disability Payment?

Veterans can view their compensation details or apply for additional benefits by logging into the official VA portal: https://www.va.gov/.

The VA Disability Pay Chart 2024 ensures that veterans receive fair and inflation-adjusted benefits for their service-connected disabilities. Understanding these rates and additional allowances is crucial to securing the financial assistance you deserve.

FAQs

The VA disability COLA increase for 2024 is 3.2%, ensuring payments keep up with inflation.

Yes, if you have a 30% or higher disability rating, you may apply for extra benefits for your spouse, children, or dependent parents.

No, VA disability benefits are tax-free, providing veterans with full financial relief.